Relocating from Uganda to India is a massive undertaking. You ought to be aware of the laws and procedures that will govern your move as well as what you must complete before shifting to India.

We’ll go through some essential aspects of moving from Uganda to India, including how much it costs, what documents are needed and when they must be submitted, and how long it takes for household goods and personal effects to arrive at their destination country.

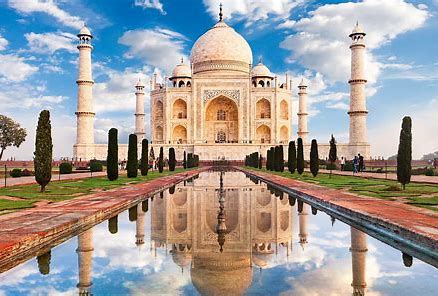

India, also referred to as the Republic of India, is the world’s second-most populous nation after China.

In the Indian Republic, there are 28 states and 8 union territories. The capital of India, New Delhi, is home to the offices of all three arms of the Indian government. These include the Parliament Building, the Supreme Court of India, and Rashtrapati Bhavan.

India has 22 national languages, with Hindi being the country’s most dominant language. The Indus Valley civilization, the oldest, most significant, and longest-lasting civilization in the world, originated from India.

The fact that India is the only country to have an entire ocean named after it is equally noteworthy. There are also most national films there.

If you’re planning on making a move from Uganda to India, here are things that will help make your transition easier:

Household Goods and Personal Effects Are Imported Under the Transfer of Residence Rules

Goods must be imported within six months of arrival in India but can be delayed if you apply for a single entry visa.

You will need to declare all your household goods and personal belongings on arrival in India with your passport at the airport or port where you land.

Under the Transfer of Residence regulations, Indian nationals and foreign nationals (including those of Indian descent) are permitted to import their household goods and personal things into India. Nevertheless, a few restrictions apply:

· Foreign nationals need a work, residence, business, or entrance visa.

· The owner of the items must move to India.

· The owner of the goods must have spent at least two years living abroad.

· If the owner of the items is an Indian national, they must not have traveled there more than 180 days in the two years prior.

· The owner of the items or any family members should have avoided taking advantage of the Transfer of Residence advantages during the three years prior.

Duty-Free Allowance Only Applies in Certain Instances

Duty-free allowance only applies to returning Indian nationals who have been away from India for more than three years.

It does not apply to any other categories of people, including those who are moving back to India after having been away for less than three years or those who do not hold citizenship status with India.

The Transfer of Residence regulations in India only permits the duty-free importation of worn and outdated home items.

That implies they had to be under your care for at least six months. Even then, only certain items are permitted:

· Books, clothing, cookware, furniture, and small equipment like juicers, mixers, and ironing boards are examples of personal effects and household items.

· Videocassette disk players, video cassette recorders, or video television receivers

· Range with electricity or liquefied petroleum gas (LPG)

· Domestic refrigerators with a 300-liter capacity

· Computers, specifically (desktop computers)

· Computers on wheels or notebooks

· Washing equipment

Returning Indian Nationals Enjoy Additional Concessions When Importing Personal Property

If you are a returning Indian national and would like to import personal goods for trade or use during your stay in India, the following concessions will be available:

Returning citizens who have lived abroad for at least three months are eligible to import duty-free used home items worth up to Rs. 6,000/UGX 268,200 and professional equipment worth up to Rs. 10,000/UGX 447,000.

Returning citizens who have lived abroad for at least six months are eligible to import duty-free used home items up to a total of Rs. 6,000/UGX 268,200 and professional equipment up to a maximum value of Rs. 20,000/UGX 894,100.

The importation of jewelry up to Rs. 10,000/UGX 447,000 for men and Rs. 20,000/UGX 894,100 for women is permitted for returning Indian citizens who have lived abroad for at least a year.

Returning Indian citizens who haven’t lived abroad for more than a year are eligible for duty-free exemptions provided the combined worth of their household goods and personal things is less than Rs. 30,000/UGX 1,341,200.

These sums could change at any time, per notifications from the customs authorities, depending on the state of the market and other variables influencing commerce between India and Uganda.

Certain Documents Are Required When Importing Household Goods and Personal Effects into India

Import license: This document is issued by the Department of Industrial Policy and Promotion (DIPP), Ministry of Commerce, Government of India.

It is required to import goods worth more than USD 10,000 into India.

· Bill of lading: A bill of lading agreement between two parties that a shipment has been made and that the final destination will be specified by both parties.

· This can be used as proof when your shipment arrives in India or when you want to send back any products from there.

· Passport: If you are shifting with family members or friends who have tickets but not visas yet, they may also need one.

· They’re also helpful when entering cities like Mumbai because they allow you access without reservations beforehand.

· Visa is required for stays longer than 30 days (should also be valid for at least one year)

· English-language detailed, appraised, and itemized inventory (should have brands, dates of purchase, and the serial numbers of all major appliances)

· Letter of assignment, transfer, or employment

· Initial residence authorization (for foreigners)

· A list of electrical goods

· A contract of insurance

· Customs declaration for luggage (signed by witnesses of customs officer)

Importing Your Motor Vehicle Isn’t Recommended

While bringing your vehicle with you is a good idea, there are some things to consider before you do.

For one thing, taxes and duties on imported vehicles are high; in Uganda, they’re as much as 30%. Furthermore, insurance for such a vehicle can be costly.

Only automobiles exempt from diplomatic duties in New Delhi are cleared through customs. However, the following rules apply if your vehicle isn’t exempt from duty:

· Typically, assignments exceed 200% of the vehicle’s assessed value by customs.

· All customs fees for the car must be paid in Indian Rupees.

· If you travel to India on a Transfer of Residence, you can only bring one used car.

· Only right-hand drive automobiles may be imported (diplomats are excluded from this rule)

· The age of your vehicle must be at most three years from the date of production.

· A speedometer in your car must display the speed in kilometers per hour.

· Your vehicle must adhere to Euro III emission standards, as stated on its manufacturer’s.

· Foreigners living in India can drive any motor vehicle as long as they have a valid international driver’s license that is good for one year, despite the complex and time-consuming process of importing an automobile.

It is important to remember that India’s traffic is hazardous and uncontrolled due to poor road management.

Therefore, given their relatively modest prices, using cabs may be wise. However, you must haggle over the fee with the driver before getting in a taxi.

And suppose your car does break down in India. In that case, there’s no guarantee that your local mechanic will have experience working on foreign vehicles or understand how important it is for them to be appropriately treated.

Documents Required When Importing Motor Vehicles and Pets into India

When importing vehicles, you must ensure that the vehicle meets all the requirements of Indian law.

You will also have to obtain a valid import permit and vehicle registration certificate.

Here are some documents that you should bring with you:

· Original vehicle title and registration.

· Authentic passport. First-time bill of lading.

· When importing, a 2-year “No Sale” bond must be completed for Insurance coverage.

· Manufacturer’s original invoice.

· List of add-ons, if any, and the date of purchase.

If you’re determined to bring pets into India, you must know that each immigrant who enters the nation under the Transfer of Residence can only carry one dog, cat, or parrot.

Dog importers must ensure that their animals are immunized against leishmaniasis, rabies, distemper, aujossky’s illness, and leptospirosis.

The necessary paperwork for pets includes the following:

Veterinary health certificate, a record of vaccinations, and an Advance NOC from India’s Department of Animal Quarantine

Goods Must Be Shipped Out Within 30 Days of the Owner’s Arrival in India

Goods must be shipped out within 30 days of the owner’s arrival in India to get your interests registered with the customs.

The ideal method to achieve this is to have them delivered to any port in India or even a warehouse that is bonded by customs, where they will be kept in storage until the time of their subsequent shipment.

India mandates that sea shipments covered by the Transfer of Residence regulations be sent from the origin ports no later than one month following the arrival of the items’ owner in India.

Air shipments, on the other hand, must be sent out of the airport of origin within 15 days of the owner of the goods arriving in India. Motor vehicles may be imported within six months after the arrival date.

Your products will only be cleared if the shipment is delayed in any way if the customs officials approve of the delay. Each case is evaluated on its own merits.

Even though shipments may reach an Indian airport or seaport two months before the owner of the items arrives.

All Shipments Are Subject to Customs Exams

If you are shipping a vehicle, you will need to pay customs duty and import tax at the port of entry into India.

The front or opening side of the container or lift vehicle should be loaded with your shipment’s electronic equipment.

When there is a good packing list, and your items match the packing list when they are randomly verified, customs may choose to inspect 20 to 30 percent of your shipment.

The time it takes to clear customs can range from one to two weeks due to the meticulous screening of shipments coming into India.

It’s essential to keep in mind that although India’s customs laws are uniform, they could be interpreted differently by each customs office.

Keep in mind that there are two options available to you when considering importing items into India:

If you are shipping personal effects such as clothes and jewelry, no additional tax is imposed on these items when they arrive in India.

It takes around 9 to 13 hours to move from Uganda to India via plane

Moving from one country to another is always stressful, but planning can make it easier.

The first thing you should know about traveling by plane between Uganda and India is that the duration of the trip will depend on the airline and the distance between the two nations.

If you are traveling by air, it takes around 9-13 hours by plane from Uganda to India.

However, there are many stops along the way. In that case, this number may increase significantly due to layovers, delays caused by bad weather conditions, or mechanical issues with an aircraft, such as engine failure.

The second thing that affects how long your flight will take is its location: whether it’s sunny or rainy season in both countries, whether they’re experiencing winter months or not.

All these factors play into what kind of experience you’ll have while waiting on board at airport terminals during their peak hours, which means loading up suitcases full-up luggage before heading off into different parts of town during off-peak periods could save you significant amounts of time overall.

Before shifting to India, there are a lot of factors to take into account. You must be prepared for a culture shock and ensure you have everything you need to make it through the transition.

However, by following these tips, you can ensure that your move is as smooth as possible.

We hope this information was useful to you and helped to clarify any concerns you may have had about relocating to India.